Secured Investments

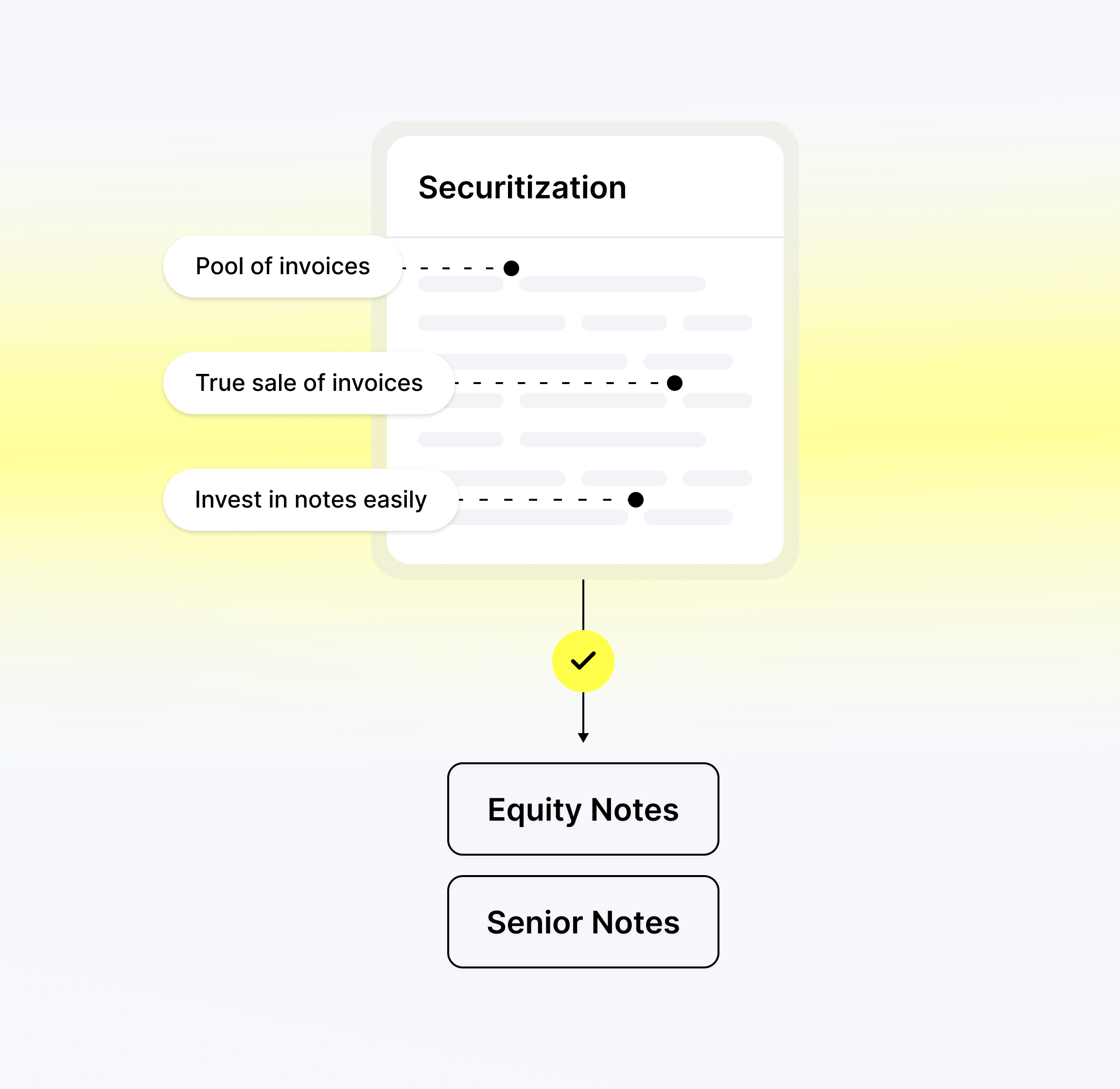

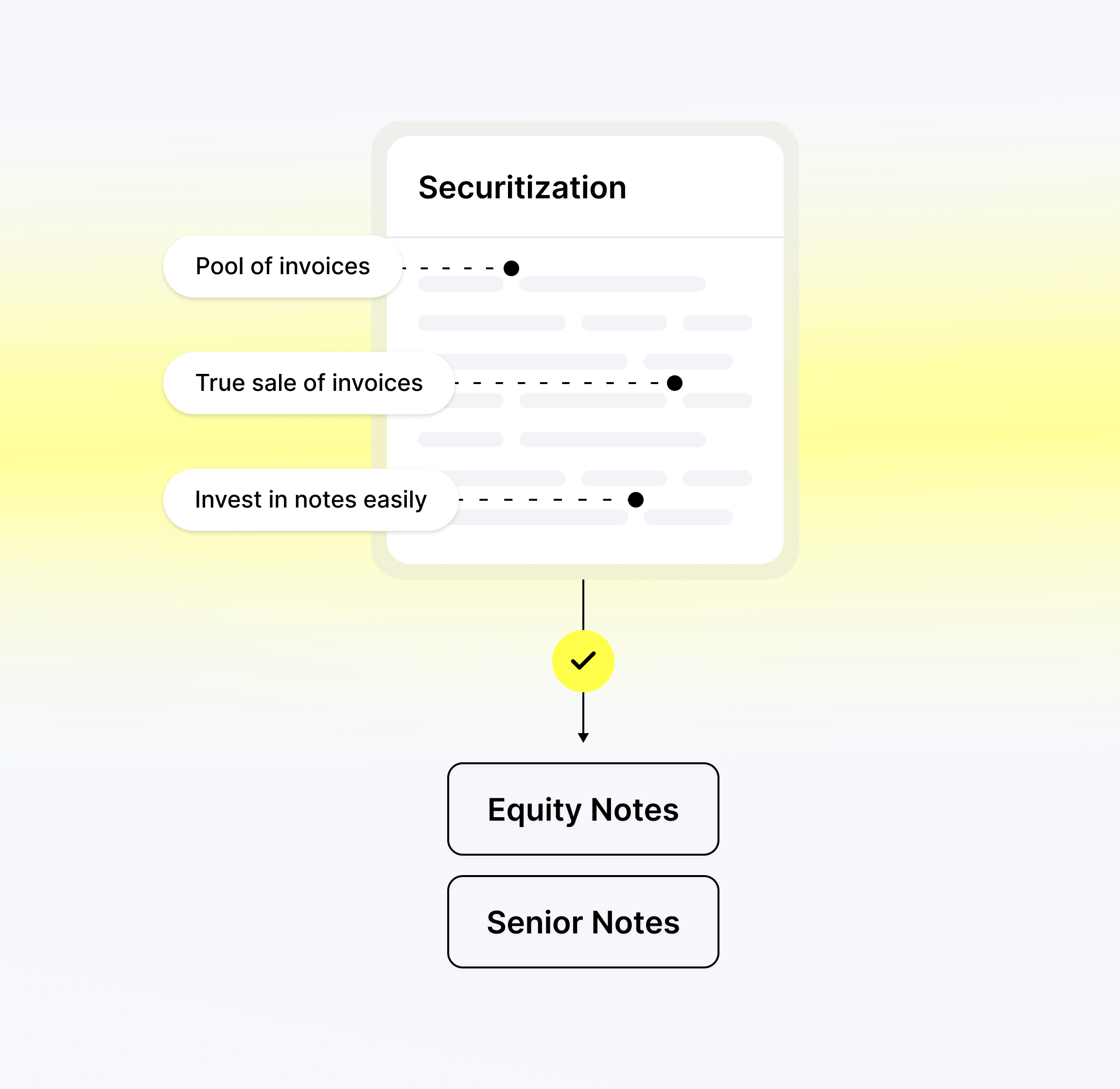

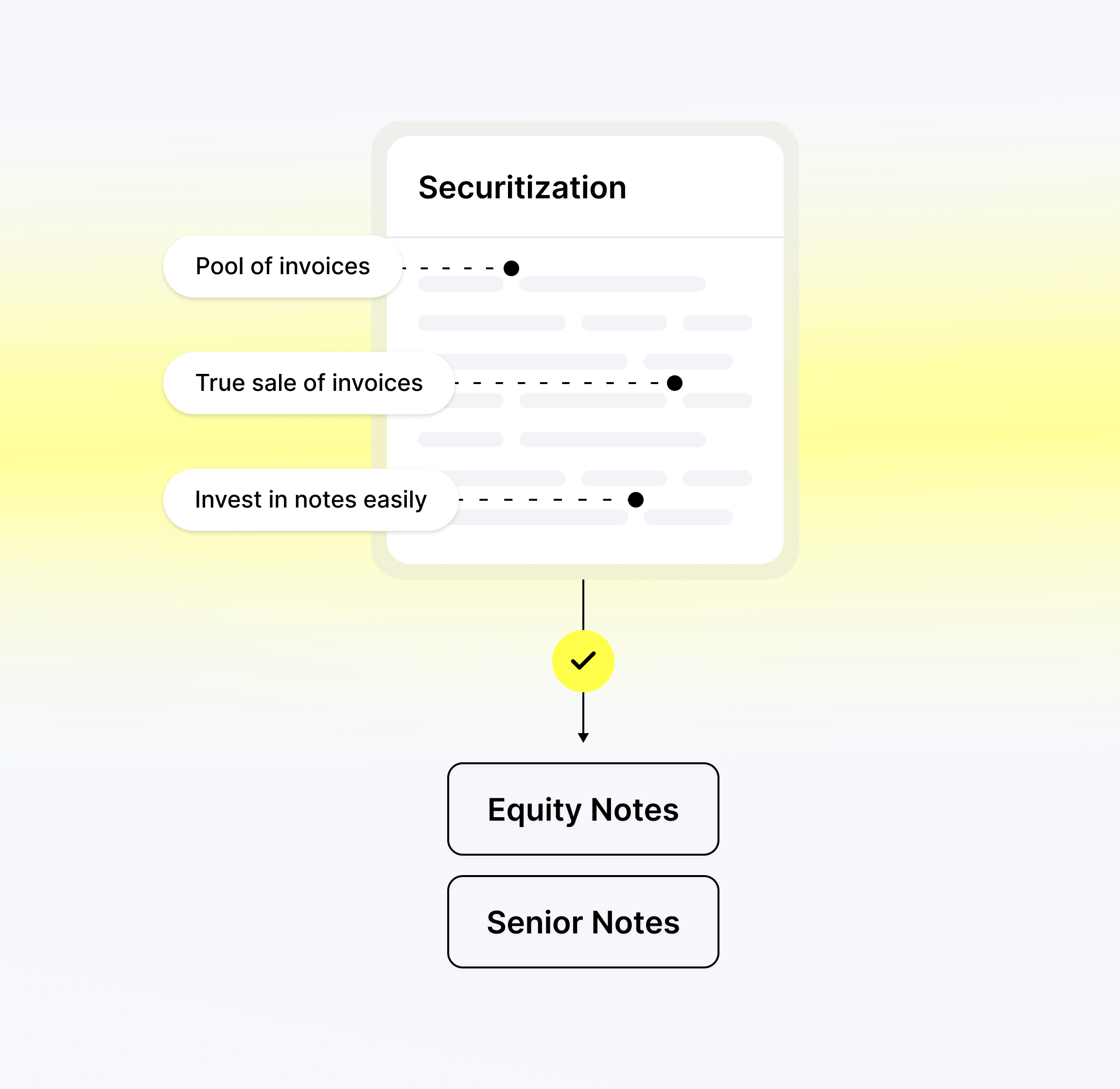

Finvx offers a way for investors to support medium-sized businesses by buying a pool of invoices from these companies

Benefits

What are the benefits of investing with Finvx

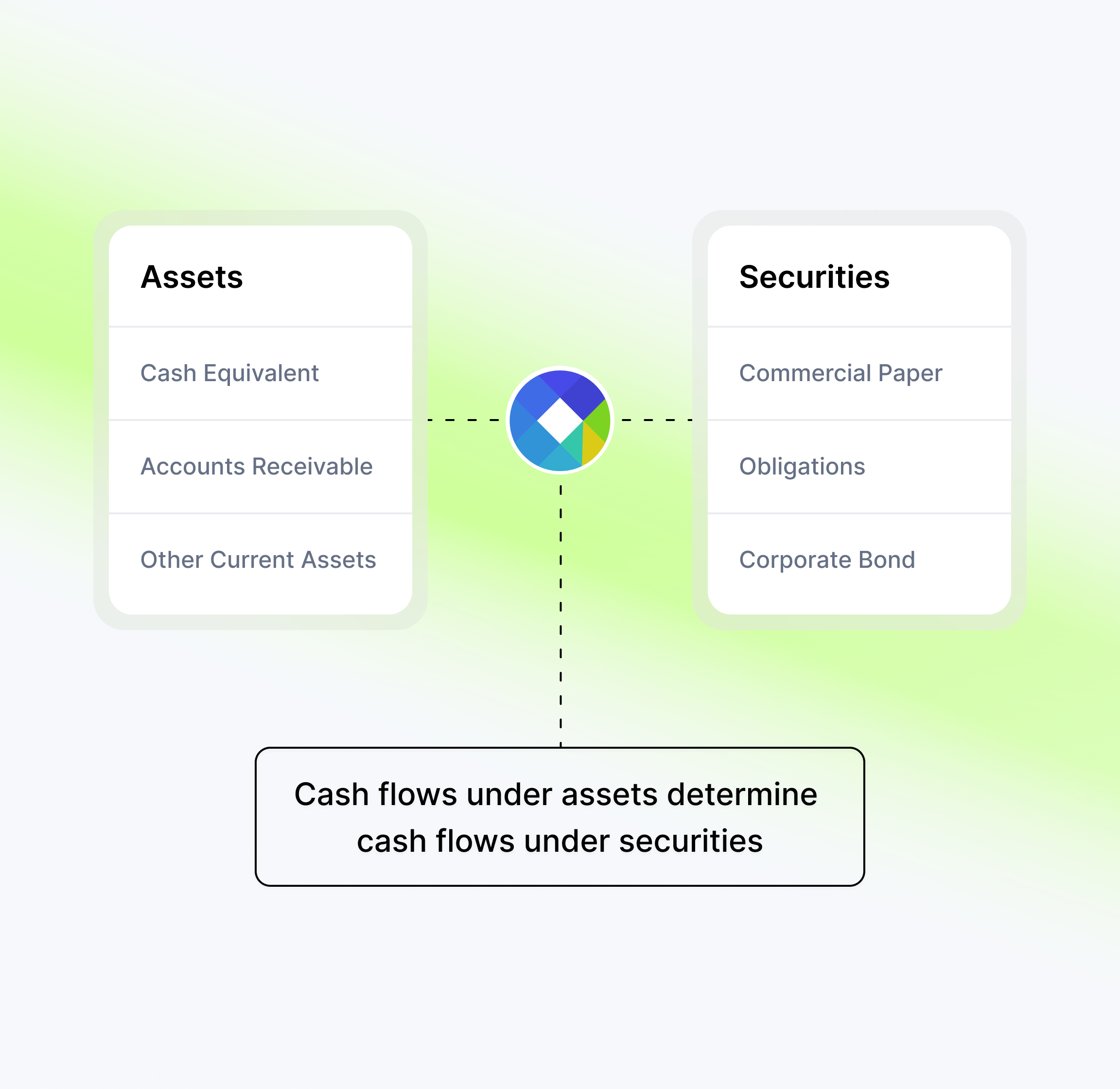

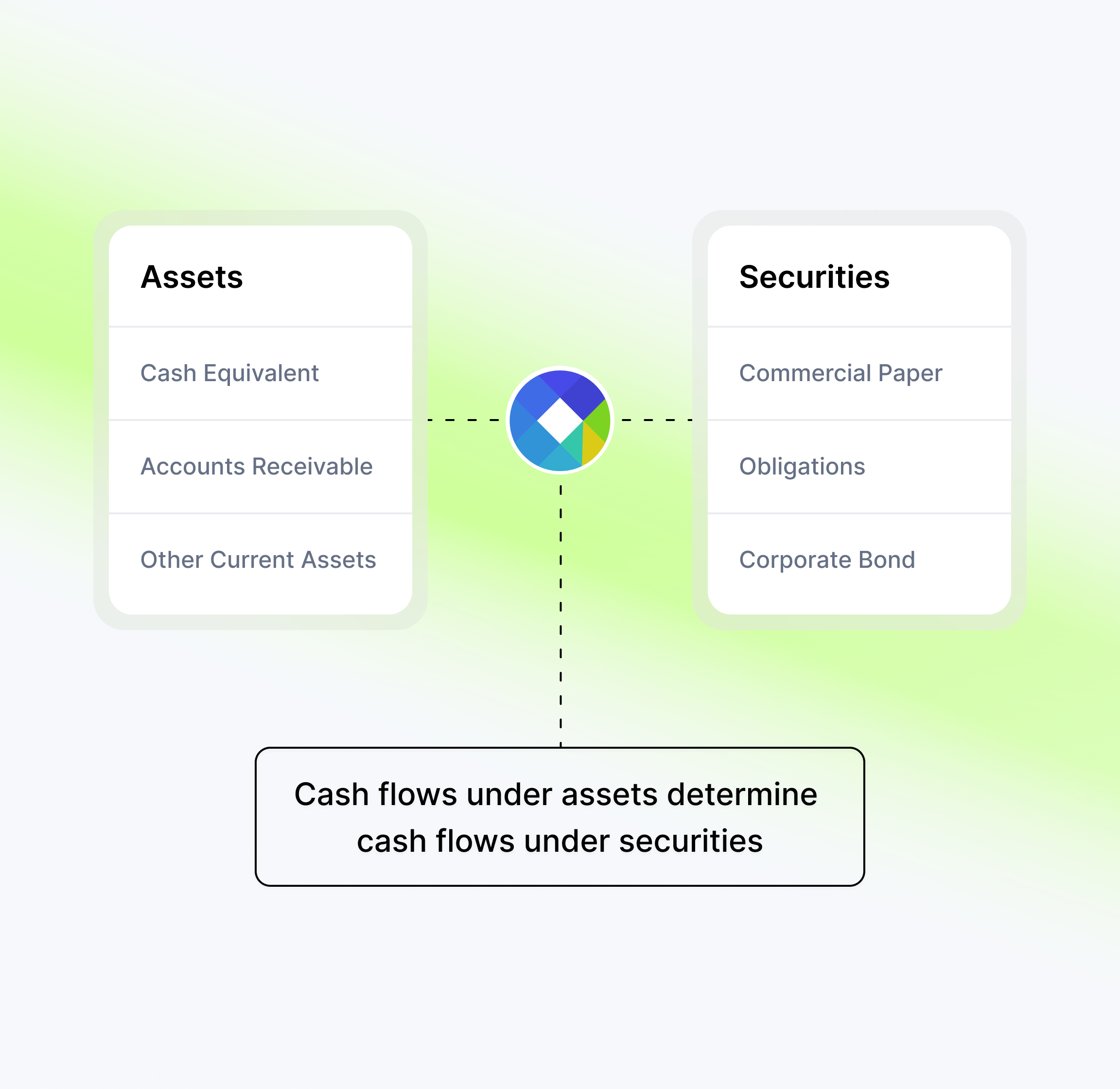

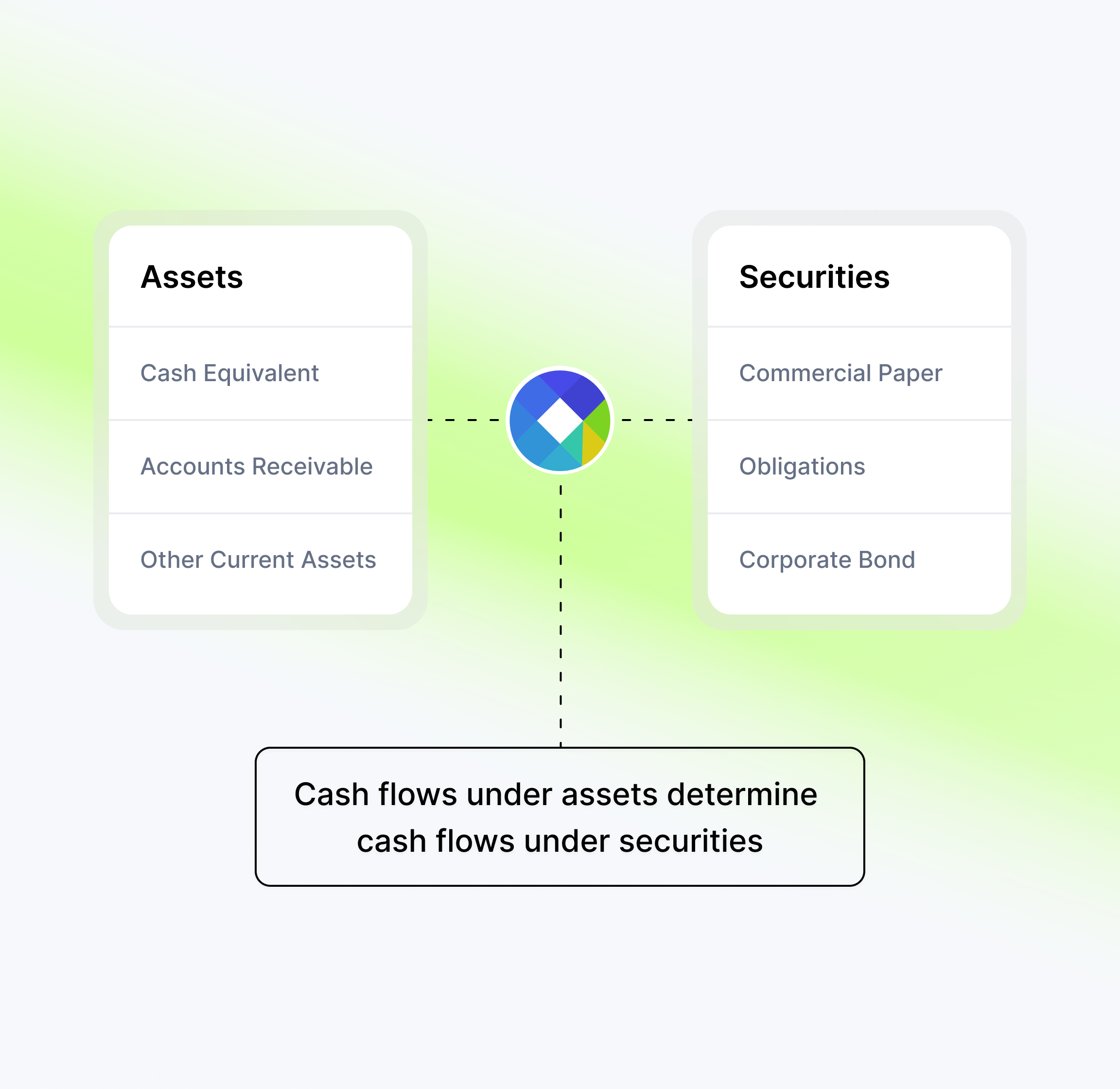

Invest in predetermined cash flow of growing companies backed by a pool of securitized trade finance assets

Risk diversification

Investing in a pool of diversified receivables helps spread the risk, increasing the potential for stable returns

Asset-backed security

The investment is secured by underlying assets (i.e. the trade receivables), providing an added layer of protection to the investors.

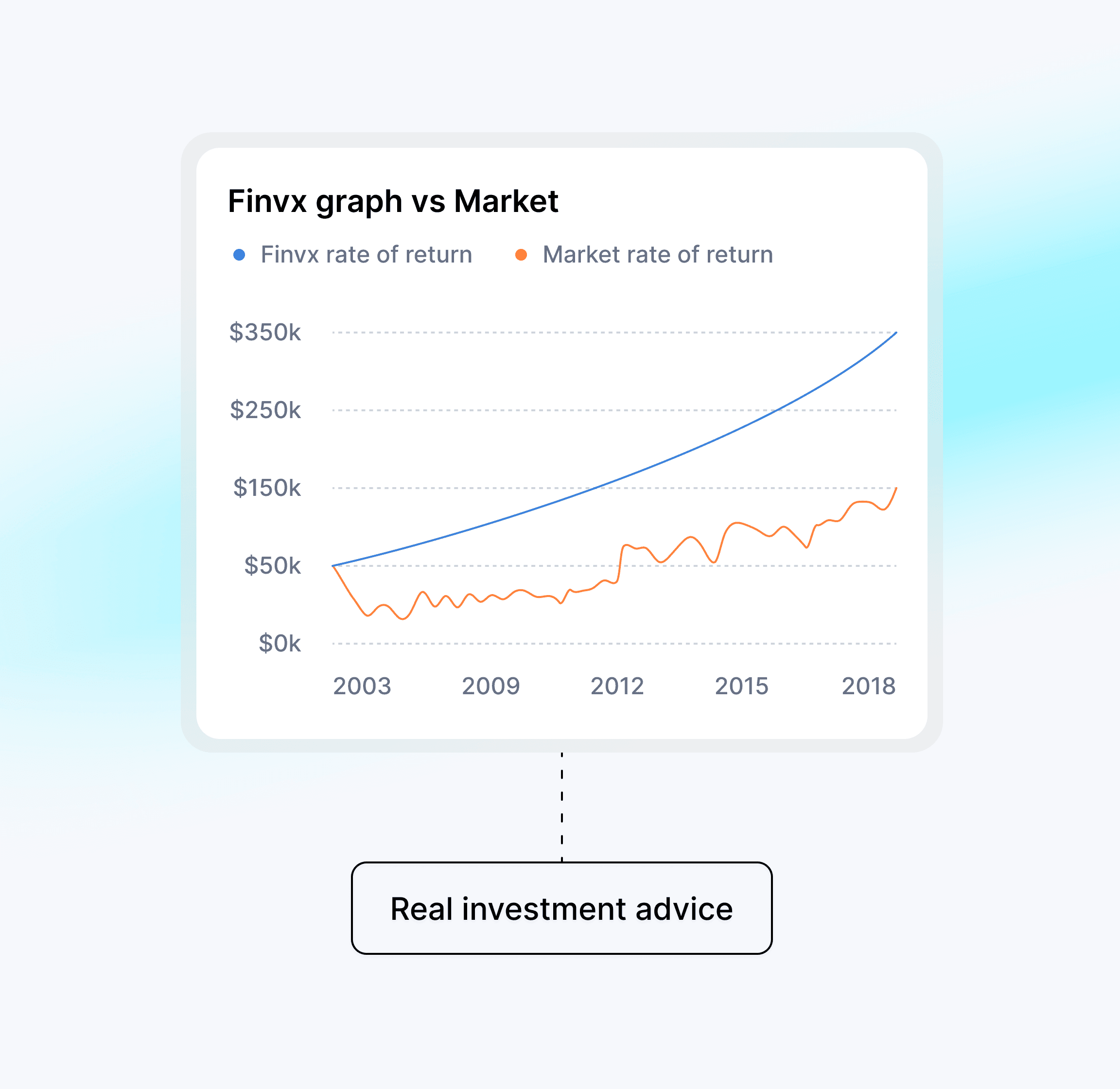

Higher returns

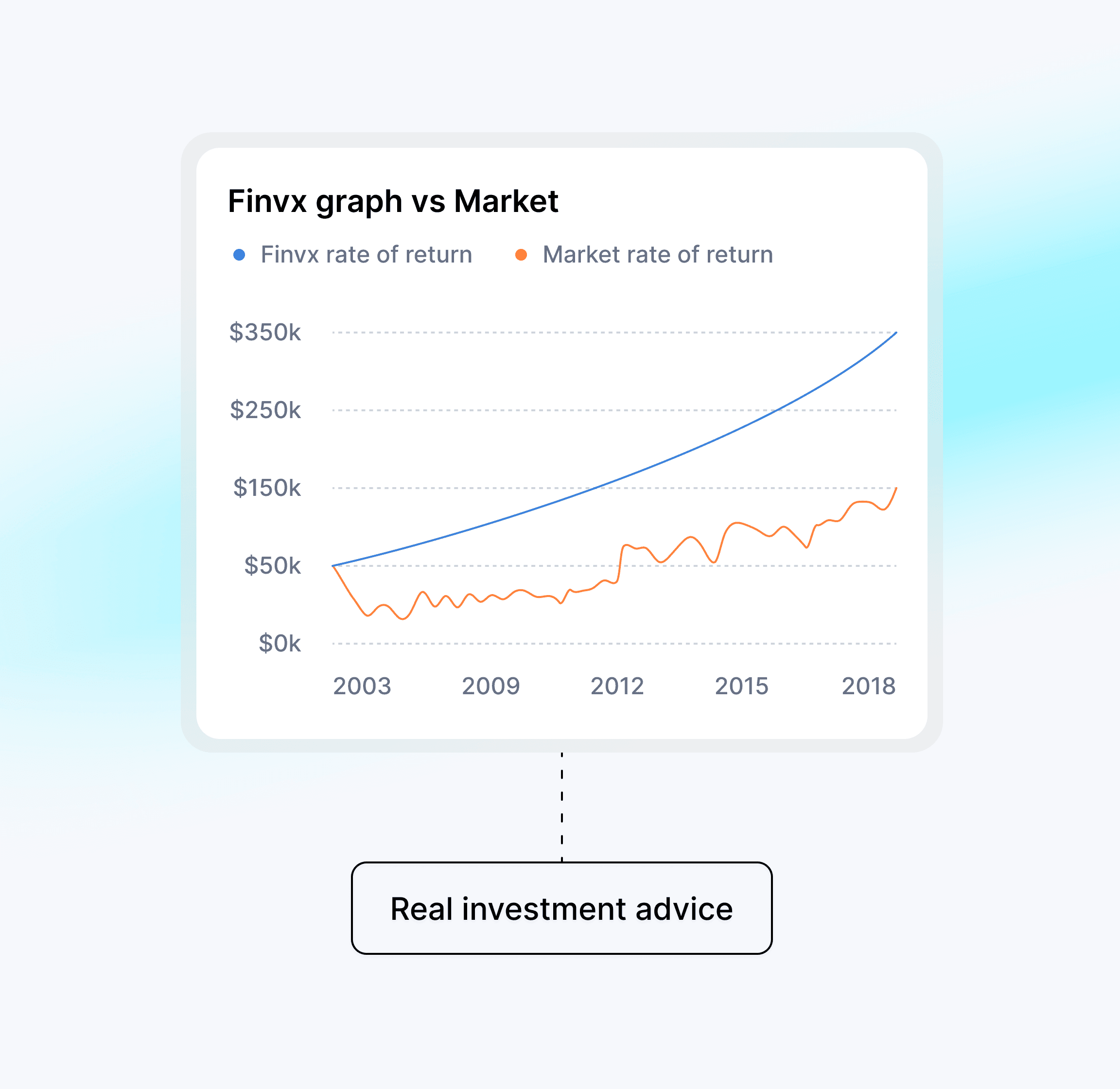

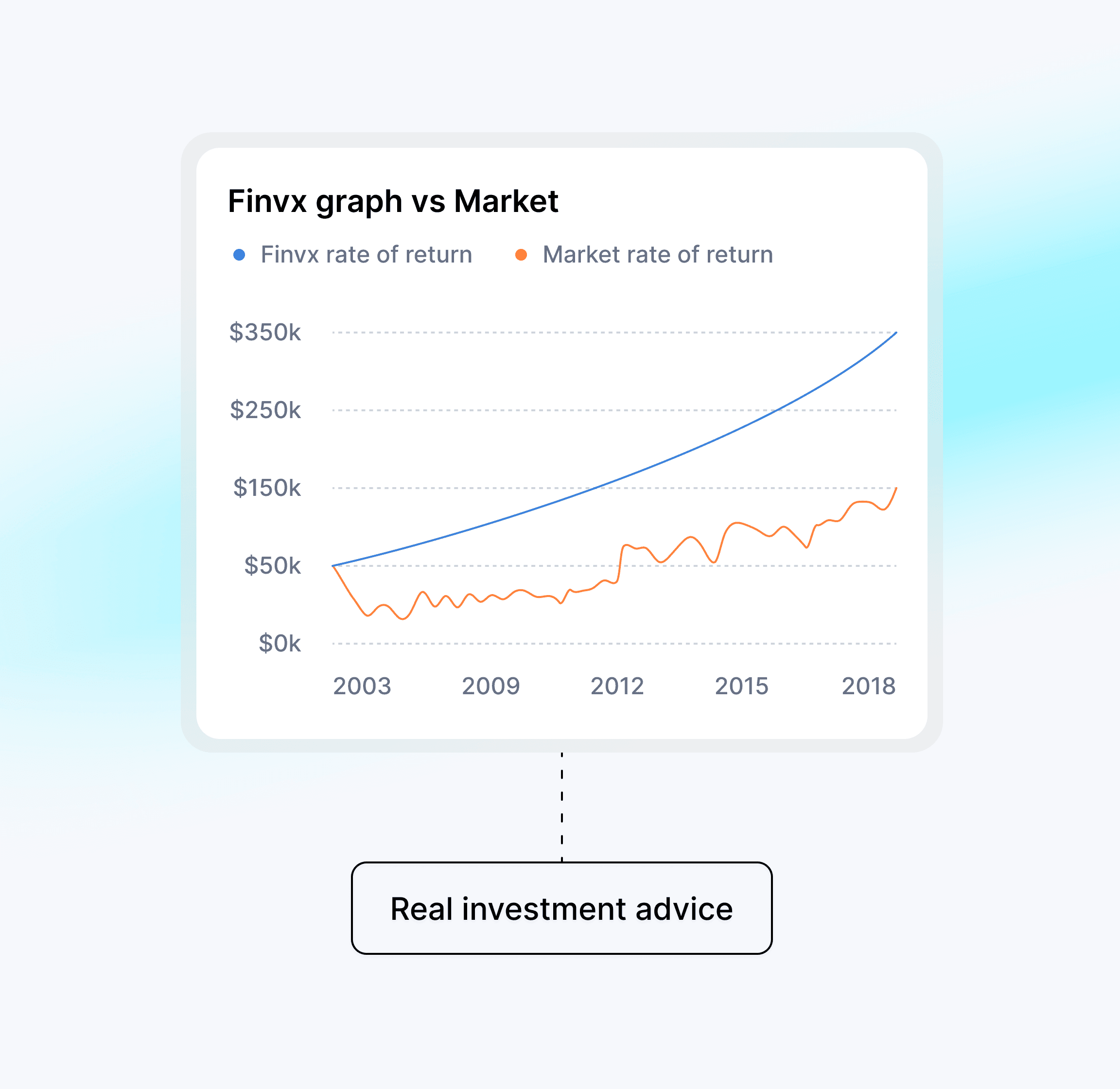

Exposure to a blue-chip company through the supplier receivables with higher returns compared to other exposures (i.e., shares, bonds)

Frequently asked questions

Everything you need to know about the product and billing.

Who is eligible to invest in trade receivable securitization?

Trade receivable securitization targets professional investors. A minimum capital of €100,000 is required. This threshold ensures investor financial capability and understanding of this investment class.

What are the returns expected from investing in trade receivable securitization?

What is an SPV note in the context of trade receivable securitization?

Why is Luxembourg considered a favorable jurisdiction for SPVs?

How does investing in bonds differ from trade receivable securitization?

Join 5,000+ companies growing with Finvx

Get started today and accelerate your cash flow

Finvx is operated by Finvx Management SARL, a company incorporate and registered in Luxembourg, RCS registration number B275647 and FINVX SECURITIES Securitization funds. Registration number: O61.

Finvx is operated by Finvx Management SARL, a company incorporate and registered in Luxembourg, RCS registration number B275647 and FINVX SECURITIES Securitization funds. Registration number: O61.

Frequently asked questions

Everything you need to know about the product and billing.

Who is eligible to invest in trade receivable securitization?

Trade receivable securitization targets professional investors. A minimum capital of €100,000 is required. This threshold ensures investor financial capability and understanding of this investment class.

What are the returns expected from investing in trade receivable securitization?

What is an SPV note in the context of trade receivable securitization?

Why is Luxembourg considered a favorable jurisdiction for SPVs?

How does investing in bonds differ from trade receivable securitization?

Investment Opportunities

Finvx offers a way for investors to support medium-sized businesses by buying a pool of invoices from these companies

Investment Opportunities

Finvx offers a way for investors to support medium-sized businesses by buying a pool of invoices from these companies

Benefits

What are the benefits of investing with Finvx

Invest in predetermined cash flow of growing companies backed by a pool of securitized trade finance assets

Risk diversification

Investing in a pool of diversified receivables helps spread the risk, increasing the potential for stable returns

Asset-backed security

The investment is secured by underlying assets (i.e. the trade receivables), providing an added layer of protection to the investors.

Higher returns

Exposure to a blue-chip company through the supplier receivables with higher returns compared to other exposures (i.e., shares, bonds)

Join 5,000+ companies growing with Finvx

Get started today and accelerate your cash flow

Join 5,000+ companies growing with Finvx

Get started today and accelerate your cash flow